Australia: The wait continues

Brunei Darussalam: Islamic banking and finance

China: The dragon stirs

Hong Kong: The gatekeeper

Indonesia: Playing catch-up

Japan: Reviewing priorities

Korea: Government intervention crucial

Malaysia: Cautiously optimistic

Singapore: High expectations

Thailand: Focusing on capital markets

The Full Guide 2012

Australia: The wait continues

Professor Michael Skully

In 2010 Islamic finance was the flavor of the month. Politicans gave speeches supporting it and a host of seminars explained its workings. This all resulted in part from a 2009 review of Australia as an international financial center (the Johnson Report) which had made several recommendations about Islamic finance. The report also identified several obstacles – particularly in regards to taxation – that would need resolving. The Australian government responded in 2010 by asking the Board of Taxation to review these matters and make recommendations accordingly.

The Board of Taxation released a discussion paper in October 2010 and called for public submissions. Most observers were positive about the board’s approach and took the opportunity to explain how these obstacles might be resolved. The board considered this input, and no doubt revised their findings and recommendations accordingly, before reporting formally to the government in mid-2011.

Unfortunately no one outside the board or the government knows yet what was recommended. Typically such reports are not released until the government decides its own response. Some thought that the government would release the report in September 2011 and hopefully its response, but as of early December, we are none the wiser.

For 2011, if everyone waited on the Australian government before doing anything, there would be little to report. Nevertheless, the private sector did have some positive outcomes.

September 2011, for example, saw the formal launch of the Qard Hassan Victoria No Interest Loan Scheme (NILS). This program is run in Victoria (Melbourne) under the auspices of the Islamic Council of Victoria and with the support of a Christian NGO, the Good Shepherd Youth & Family Services. The latter’s lending is funded by AU$15 million (US$15.12 million) in capital provided by the National Australia Bank. Other Islamic bodies will help run similar NILS programs in other states. In each case, the operations will be run under the supervision of a Shariah Supervisory Board. The amount lent is small with a maximum loan limited to AU$1,000 (US$1,007.93) and repaid within 18 months. They are designed for purchasing consumer durables (household applicances), furniture and education expenses. While advances are limited to low income borrowers, the money cannot be used to cover normal living expenses or debt consolidations. The money is also paid directly to the provider – the borrower does not receive cash. The Good Shepherd’s own NILS, developed some 21 years ago, has an excellent repayment rate and the Qard Hassan scheme is expected to do even better.

On a more commercial front, the MCCA Islamic Finance & Investments group has continued its transformation from simply a cooperative Islamic institution to a multi-facet financial services provider. Its MCCA Income Fund, which provided a 5.31% return last year, now has funds under management of some AU$12.5 million (US$12.59 million). The return of the local securitization market in mid-2011 also opens an additional opportunity for further mortgage funding. On other fronts, MCCA sees other Shariah compliant opportunities such as a MCCA Unlisted Property Trust and perhaps an Islamic banking license.

On the banking front, the minimum AU$50 million (US$50.38 million) in equity capital required for a banking license may limit the ability of local Australian groups to form such an institution, but a joint venture with other financial interests might be more likely. Similarly, a range of foreign interests might even form their own institutions directly. HSBC, for example, has long had a local subsidiary in Australia and is already an active player in Islamic finance overseas. So it would seemingly be well placed to offer these services directly in Australia and would probably face less regulatory issues with the local regulator, the Australian Prudential Regulation Authority, than any new arrival. Other local banks, such as ANZ, also have direct overseas experience which again could be reapplied at home.

Meanwhile in the capital markets, Westpac has already experimented with obtaining some of its treasury funding using commodity-based Islamic instruments and NAB is known to be considering its own small involvement in the Sukuk area. Crescent Investments is also active in providing Shariah compliant managed funds, particularly to the local superannuation funds market, and the NGS Super now offers a similar Shariah fund choice to its members.

Real progress in 2012 remains contingent on the Australian federal government formalizing the application of appropriate taxation law that considers the outcome rather than the technical legal specifics of an Islamic financial transaction. As the current taxation regime is supposed to follow exactly that principle, it doesn’t seem all that hard to do. The government just needs to do it.

Professor Michael Skully is the chair of banking in the accounting and finance department at Monash University, Australia. He can be contacted at michael.skully@monash.edu . Brunei Darussalam: Islamic banking and finance

James Chiew

Islamic banking market in Brunei Darussalam was initiated in 1991 with the set-up of the Tabung Amanah Islam Brunei Darussalam. Next the Island Development Bank, a conventional bank, was converted into the Islamic Bank of Brunei on the 13th January 1993 (the bank has since merged into the Bank Islam Brunei Darussalam [BIBD].

The impetus for Islamic banking into Brunei was a Titah of His Majesty the Sultan and Yang Di-Pertuan on the 25th September 1990 in a meeting of the Majlis Ugama Islam of Brunei:

“If we are not able to do something, it does not mean that we just sit still and do nothing. If we are really unable because we do not have skilled labor or the expertise, and yet we are in dire need to meet the demands, say for example, of Fardhu Kifayah, then what is wrong in following the international practice or traditions of nations by the mutual exchange of information or undergoing training or, if necessary, the hiring of experts on temporary employment with us to help us make our projects succeed the way we plan and desire? For example, [in] the matter concerning the Islamic financial system, the most popular nowadays is the Islamic bank. It is no longer a dream or imagination, but we are informed that there are already more than fifty Islamic commercial banks in Islamic countries... This is also one of the obligations of Fardhu Kifayah for each of the said Islamic countries, including our State of Brunei Darussalam....” (Pehin Tuan Imam Dato Paduka Seri Setia Ustaz Haji Awang Abdul Aziz bin Juned, 2008, p.169).

Traditionally, Islamic banking in Brunei offers products that are supported by classical Muamalat concepts such as al-Bai’ Bithaman Ajil (home financing, overdrafts and facilities), Mudharabah deposits, Wadiah accounts, ar-Rahnu (pawnbroking), Ijarah Thumma al-Bai’ (hire purchase) and Murabahah letters of credit.

In the last 12 months

In the last two years, BIBD has taken serious initiatives to introduce equitable Islamic products. Amongst the equity-based products (not asset-based) developed recently are:

In the last two years, BIBD has taken serious initiatives to introduce equitable Islamic products. Amongst the equity-based products (not asset-based) developed recently are:

a) The Musharakah (partnership) to finance SMEs;

b) Musharakah Mutanaqisaha: A home-ownership financing in which the bank assumes ownership risks.

b) Musharakah Mutanaqisaha: A home-ownership financing in which the bank assumes ownership risks.

The catalysts for change are two fold: (i) The anxiety of Brunei Islamic scholars to avoid Shubh (doubt) the BBA may offend Riba laws; and (ii) Upholding the cardinal Fiqh “Al-Ghunmu bi al-Ghurmi” (gain accompanies liability for loss).

Sukuk has not made much headway in the kingdom. The first Sukuk Ijarah was initiated by the Islamic Development Bank of Brunei (now merged into BIBD) and BLNG in 2006. Subsequently a short-term money market Sukuk Ijarah Program was issued by the government of Brunei Darussalam. Neither issuance is traded in the secondary market. Since then, there has been no new Sukuk issuance. Material legislation to support and regulate Islamic capital market products and activities is still pending.

Significant legislation introduced recently includes:

Significant legislation introduced recently includes:

a. The Deposit Protection Order 2010 for the protection of ordinary depositors who deposit money in banks, including Islamic banks, against default.

b. The Autoriti Monetari Brunei Darussalam 2010, a central bank for Brunei with functions including the supervision and regulation of Islamic banks.

c. The Accounting Standards Order 2010, which seeks to set and regulate accounting standards in Brunei. It is not yet known whether there is any need to cater for certain aspects of Islamic banking and finance under the standards.

2012 and beyond

It is expected that BIBD will continue to exert efforts to introduce new equity-based products.

It is expected that BIBD will continue to exert efforts to introduce new equity-based products.

Key to the healthy development of Islamic banking and finance in Brunei will be the following factors:

Regulators must take a less paternalistic and more maternalistic approach, and cooperate with the private sector by providing guidelines for uncertainty rules (gharah) and considering the views of industry players (shurah).

The Stamp Act, Cap. 34 (based on the English Stamp Act of 1819) and the Land Code, Cap. 34 (enacted in 1909), inhibits the growth of Islamic banking creating and maintains an unequal playing field with conventional banks: and should therefore be updated.

Laws should be codified, e.g. the basic rules of classical concepts like Mudharabah, Musharakah and Ijarah, to reduce arguments and promote certainty, which benefits product developers and lawyers. As Islamic banking and finance gains in complexity, involving combinations of an array of Islamic classical concepts, this will become more difficult. For example, Riba, amongst a host of other legal issues, has been debated for 1,500 years with no conclusion. Inclusion of the four Madhhabs with conflicting views produces flexibility but invites uncertainty in the law.

Muhd Jamil Abas bin Abdul ‘Ali @ James Chiew is a legal advisor at Abrahams, Davidson & Co, Brunei Darussalam. He can be contacted at chiewjamessh@brunet.bn .

With an estimated Muslim population of between 22-26 million, and strong economic ties with the Middle East, Malaysia and Indonesia, there is vast potential for the growth of Islamic banking and financing in China. Chinese attempts to tap into this potential appeared to have been first made in 2009 when the government granted a licence to the Bank of Ningxia to establish the first Islamic bank in China. This was heralded as being the first milestone in the serious development of Islamic finance in the world’s second largest economy.

However, whilst Islamic finance has remained on the political agenda, further developments have been few and far between. Although this may be partially due to factors such as the Arab spring, the Eurozone crisis and the slowing economy, it also appears that there is a lack of political initiative at present to truly engage in the creation of an Islamic finance industry in China.

This article will review the Islamic finance developments made in China throughout 2011 before providing a preview of the industry for 2012.

Developments in 2011: A review

With the economic difficulties encountered by much of Europe and the US, 2011 marked a significant shift of focus from west to east for the banking and investment sector. Although China has not been immune to the economic slowdown, it remains on course to record growth of around 9%.

With the economic difficulties encountered by much of Europe and the US, 2011 marked a significant shift of focus from west to east for the banking and investment sector. Although China has not been immune to the economic slowdown, it remains on course to record growth of around 9%.

All of this suggests that China provides the perfect environment for pursuing the development of Islamic finance, an industry that is growing at an estimated 20% each year. However, this has sadly not been the case. Rather than pursuing this exciting new area of financing, the Chinese government appears to have slowed development to a standstill.

Despite the range of Islamic products now globally available, the government has only approved the use of Wadiah, Murabahah and Mudarabah. More worryingly, the Bank of Ningxia announced in early 2011 that it was placing on hold its plans to fully implement Islamic banking in order to assess market demand.

Although the requested 18 month ‘breathing period’ may be a reflection of the instability of global markets at present, critics will argue that this is the consequence of a lack of support for this industry from the government, who some suspect only issued the licence in the first place for politically motivated reasons.

While this may seem bleak for Islamic finance, China still offers a range of opportunities for domestic and international, and Muslim and non-Muslim, investors to utilize Islamic financing. Even with property prices falling and strict regulatory requirements, the Chinese real estate market can still provide an attractive investment opportunity, particularly for Islamic investors requiring asset-backed investments. There have been a number of attempts to use Shariah compliant funding structures to finance Chinese real estate or infrastructure projects but none of these appear to have reached financial close.

The introduction of the Measures on a Pilot Program of Foreign Invested Equity Investment Enterprises (the Shanghai Pilot Program) helps to balance the distinction between domestic and foreign-funded private equity investment in China. Although not removing the distinction, the Shanghai Pilot Program allows for easier access to domestic investors and investments, this being important for Islamic investors.

Developments in 2012: A preview

There has been little so far to suggest that 2012 will be significantly different to 2011 in terms of developments in this area. The primary focus for the government appears to remain the development of the renminbi market, with Islamic finance further down the pecking order.

There has been little so far to suggest that 2012 will be significantly different to 2011 in terms of developments in this area. The primary focus for the government appears to remain the development of the renminbi market, with Islamic finance further down the pecking order.

However, there is still clear potential for the growth of Islamic finance in China as conventional finance remains under pressure. There are clear opportunities for Chinese, Middle Eastern or Asian Islamic investors to work together within the context of Shariah compliant funds. Such funds could focus on supporting the rising number of Chinese investments in the Middle East, or be used to invest into projects in China. Shariah compliant funds are best invested in ‘bricks and mortar’ projects, providing the much needed asset-backed structure that Islamic finance relies upon, as China seeks to develop its national infrastructure whilst it gives support to its enterprises successfully undertaking infrastructural projects abroad especially in the Middle East. The use of Islamic financing for projects, such as the Shard in London, highlights that this can be a key area for investment going forward. It is likely that such investment would be most successful through a joint venture between Islamic and domestic investors, combining Islamic capital with local knowledge and expertise to good effect..

Anthony Chan is a partner at Brandt Chan & Partners in association with SNR Denton, Hong Kong. He can be contacted at anthony.chan@snrdenton.comHong Kong: The gatekeeper

Anthony Chan

After a record-breaking year for trading in exchange-listed securities and initial public offerings in 2010, Hong Kong continued to cement its position in 2011 as one of the major financial centers of the world. However, despite its market-leading role, Hong Kong appears to be sadly off the pace in providing access to the booming Islamic finance market, now estimated to be worth US$1 trillion in assets.

The early impetus of 2007 that resulted in the creation of the Hang Seng Islamic China Index Fund and the Hong Kong Islamic Index appears to have been lost amidst the 2008 global crisis and a period of political apathy towards making the necessary legislative reforms to implement this form of financing. This has seen Hong Kong fall further behind Malaysia, the market leader in this area, as well as countries such as the UK and Singapore who have been more responsive in adopting the necessary changes.

This article will review the developments made in Hong Kong in the Islamic finance sector during 2011 before providing a preview as to what 2012 may hold in store.

Developments in 2011: A review

Throughout 2011, a number of proposals and recommendations were made, and are set for implementation, for promoting and developing Hong Kong as an Islamic financial platform. These proposals will implement the Hong Kong government’s objective to transform the city into a vibrant center for Islamic finance.

Throughout 2011, a number of proposals and recommendations were made, and are set for implementation, for promoting and developing Hong Kong as an Islamic financial platform. These proposals will implement the Hong Kong government’s objective to transform the city into a vibrant center for Islamic finance.

Most recently the Financial Secretary, John Tsang, announced in November that the government was currently working on legislation to level the playing field for Sukuk and conventional bonds in Hong Kong in terms of tax liabilities. The government is aiming to hold a second round of consultations with key industry figures during the early part of 2012.

Critics of the government will note that such legislative reforms were first promised in 2007 whilst a draft bill had most recently been expected in the latter half of 2011. Although a Bill is now expected in 2012, no details as to its precise contents have yet been released.

The Hong Kong Monetary Authority (HKMA) has also expressed its support to the government in drawing up legislative proposals to modify Hong Kong’s tax laws to level the playing field between Islamic and conventional financial products. The HKMA reiterated that it would continue to build international links and enhance Hong Kong’s international profile by working closely with Bank Negara Malaysia, Malaysia’s central bank, to explore collaborative initiatives under the scope of the Memorandum of Understanding (MoU) signed in 2009. The MoU aims to further strengthen the cooperation between the two parties in a number of key areas, including building capacity and developing human capital; facilitating and promoting the development of an effective financial market infrastructure through the exchange of information and experience in developing legal, regulatory and supervisory frameworks for Islamic finance, as well as promoting cross-border financial activities through exploring harmonization of standards and documentation relating to Islamic finance transactions and promoting the consistent application of Islamic financial contracts for cross-border transactions.

Developments in 2012: A preview

Looking forward, the main developments for 2012 will likely center on the progress made with legislative reforms. Although details are limited it is anticipated that the reforms will be made to the Stamp Duty Ordinance and the Inland Revenue Ordinance, offering tax incentives to investors in Sukuk bonds. The changes should also aid the use of Sukuk Ijarah which, although structured like an equity financing, are in fact closer to debt finance leasing. Recognition of this fact should place Islamic finance products on a more even footing with conventional products, thereby encouraging greater investment.

Looking forward, the main developments for 2012 will likely center on the progress made with legislative reforms. Although details are limited it is anticipated that the reforms will be made to the Stamp Duty Ordinance and the Inland Revenue Ordinance, offering tax incentives to investors in Sukuk bonds. The changes should also aid the use of Sukuk Ijarah which, although structured like an equity financing, are in fact closer to debt finance leasing. Recognition of this fact should place Islamic finance products on a more even footing with conventional products, thereby encouraging greater investment.

There are two further areas that may see development in the Hong Kong Islamic finance sector. The first relates to renminbi-denominated Sukuk issues. Increased stimulus for investment in renminbi from mainland China and decreasing market confidence in both the euro and the US dollar mean that the renminbi market could be a source of great potential next year. Given that Hong Kong is the leading offshore renminbi market and enjoys a special relationship with mainland China, this offers a lucrative opportunity for Middle Eastern investors to exploit.

The second area relates to Islamic funds. In the latest annual Financial Development Report published by the World Economic Forum, Hong Kong has overtaken the US and the UK to top the list of the world’s leading financial systems and capital markets. As the first Asian financial center to achieve this rank, Hong Kong’s position is bolstered by a strong score in IPO activities. In line with it being the top financial center for fundraising, Hong Kong is likely to attract intellectual capital to originate Shariah compliant funds for investments in projects in both mainland China and other jurisdictions.

Anthony Chan is a partner at Brandt Chan & Partners in association with SNR Denton. He can be contacted at anthony.chan@snrdenton.comIndonesia: Playing catch-up

Rizqullah

The Islamic banking industry continues to grow amid the global economic slowdown. Islamic banking managed to maintain high growth rates as well as achieving increased market share from national banks. The performance over the last five years (2005-2010) shows that Islamic banking has been growing well. Assets grew by 36.1%, finance 35.0% and 37.3% TPF.

The growth of Islamic banking was higher than the growth of the conventional banking industry: whose assets grew 15.4%, loans 20.5% and deposits 15.7%. Besides this, the market share of Islamic banking increased in 2011 from 2010: to reach 12.42% in terms of assets and 0.6% in the financing sphere, while deposits rose by 0.59%. This suggests that Islamic banks still have huge potential to grow.

Some factors that are increasing the growth of Islamic banking industry include, among others:

(i) Strong domestic consumption. In addition, consumer financing has been relatively unaffected by the global crisis.

(ii) Indonesia investment grade ratings are getting stronger.

(iii) The success of promotional programs and public education in Islamic banking, marked by the opening of Islamic economics studies in many universities.

From the mobilization of third party fundraising, developments in 2011 showed that third party funds increased. Deposits in September 2011 increased by 22.2% from the previous year. This relative increase is believed to be the result of improved national conditions in general, where the economy grew by 6.5% and inflation continues to slow, amounting to 4.6% (year-on-year). It is estimated that in 2012 deposits will grow higher than in 2011, given that the national macroeconomic situation in 2012 is in good shape and the plan of Islamic banking office network expansion is likely to significantly improve the collection of funds. This is also supported by the new and more easily accessible e-banking service in the Islamic banking channel.

In addition, interest rates are relatively unchanged and with the improved conditions this will benefit the position of Islamic banking in terms of the competitiveness of its funding. The improved economic growth performance also reflects the national real sector, where performance will be reflected in an increasingly competitive level of return (profit sharing) in funding for Islamic banking products. If customer bank financing, in particular for major corporations, sees a trend towards diverting funds to Islamic banks offering higher returns, then this condition can be expected to further encourage growth of deposits of Islamic banks.

In line with the funding side, the financing of Islamic banking is also experiencing high growth: up to 12.4% in September 2011. In general, this is due to national performance improvement, especially in the domestic consumption and investment sectors. By stretching its already prominent position in household consumption and investment, Islamic banking is predicted to focus on financing in the retail sector (consumer), services and trade. One fact to note is the expansion of financing cards from some Islamic banks, such as Bank BNI Syariah, which is now ready to publish its Hasanah Card, an Islamic ‘credit-like’ card.

Another phenomenon in 2011 was the pawning of gold, which experienced rapid growth of 45% per year. This growth was triggered by the issuance of the edict DSN No.77/2010 on Gold Murabahah, which allows the buying of gold in installments via Islamic banks. In addition, Act No.42 of 2009 concerning the elimination of VAT on Murabahah transactions, in effect made the performance of banking more competitive. In 2012, the national financing is predicted to grow higher than last year’s growth by relying on the domestic business sector, given the slowdown in global growth which is still happening.

In the aspect of financing, Islamic financing in Indonesia generally displayed a lower quality than the quality of bank financing nationwide. Non-performing financing of Islamic banks as of September 2011 stood at 3.6%, while the conventional banking system performed better at 2.81%. The financing problems in the Islamic banking industry are due to the supreme national sub-sector of transportation, manufacturing and construction. However, only higher growth can suppress the level of financing problems.

Another problem to be tackled by Islamic banks is the level of prudence aspects carried out by their employees. With positive economic conditions maintained in 2012, the expected level of financing problems could be reduced to a lower level than the previous year.

In 2012, it is predicted that national macroeconomic conditions will improve. This should have a similar impact on the expected performance of Islamic banking. The domestic market remains a pillar for Islamic banking to improve its performance, especially in the consumption sector, which is still a growth driver. This is also supported by consumer financing, which has been relatively unaffected by the global crisis. Islamic banking is also likely to increase its level of funding through bank network expansion and the improvement of e-channel services that provide greater convenience to clients.

The prime challenge for Islamic banking in Indonesia is how to improve the level of quantity and quality of human resources in line with business expansion; as well as how to improve services to a point where they are competitive with conventional banking services; and the innovation of products and services in terms of funding, financing, treasury and payment systems. To strengthen the performance of Islamic banking, the government as regulator is expected to provide the right incentives: such as funds management policy pilgrimage by Islamic banks, the establishment of Shariah holdings of regional development banks as well as the conversion of Shariah business units of conventional banks into Shariah banks.

Rizqullah is the president director of BNI Syariah and he can be contacted at rizqullah@bnisyariah.co.id .

Japan: Reviewing priorities

Islamic Finance news

Macro Environment

Macro impediments affecting Japanese economy include:

• Recovery from earthquake and tsunami disasters;

• Supply chain issues of manufacturers hit by Thailand floods;

• Global economy and European debt crisis;

• Strong Yen;

• Proposed consumption tax rate hikes in 2014 and 2015;

• Political uncertainties and possibility of an early general election;

• The uncertain future of nuclear power generation.

Macro impediments affecting Japanese economy include:

• Recovery from earthquake and tsunami disasters;

• Supply chain issues of manufacturers hit by Thailand floods;

• Global economy and European debt crisis;

• Strong Yen;

• Proposed consumption tax rate hikes in 2014 and 2015;

• Political uncertainties and possibility of an early general election;

• The uncertain future of nuclear power generation.

Early signs of economic recovery observed in construction and travel industries

The earthquake, tsunami and nuclear disasters of the 11th March 2011, and subsequent Thailand floods, shocked Japan and Japanese companies severely, but signs of recovery have already started to appear.

The earthquake, tsunami and nuclear disasters of the 11th March 2011, and subsequent Thailand floods, shocked Japan and Japanese companies severely, but signs of recovery have already started to appear.

The earliest signs of recovery have been seen by the construction sector. Based on research conducted by Teikoku Data Bank, a major industry newspaper has reported that demand in the region has increased for eight consecutive months and there is a significant shortage of engineering and technical personnel.

Another recovery is expected in the travel industry. JTB, the largest travel agency in Japan, expects increases in domestic and overseas travel, as well as in the numbers of foreign travelers to Japan.

Gradually, I believe, these impediments will show their multiple positive effects in the overall economy.

Prime minister Noda’s struggle for consumption tax hike and possibility of an early general election

In December 2011, Japan’s ruling Democratic Party of Japan (DPJ) approved a plan to gradually increase the consumption tax from the current level of 5% to 8% in 2014 and 10% in 2015. The cabinet endorsed this plan in early January 2012. The main reasons behind the tax hikes are increasing welfare costs due to the aging population and Japan’s already high debt-to-GDP ratio.

In December 2011, Japan’s ruling Democratic Party of Japan (DPJ) approved a plan to gradually increase the consumption tax from the current level of 5% to 8% in 2014 and 10% in 2015. The cabinet endorsed this plan in early January 2012. The main reasons behind the tax hikes are increasing welfare costs due to the aging population and Japan’s already high debt-to-GDP ratio.

An early approval of an inevitable tax hike, I believe, would be beneficial for the economy, since a future tax hike would provide a mid-term stimulus effect. Especially, the demand for large-scale household items and services, such as house renovation or automobiles, may significantly increase. In the long-term, Japanese companies are capable of achieving cost reduction targets equivalent to tax rate increases.

Business trends: new markets and product innovation, new energy, infrastructure and governance, globalization of workforce

The aging and shrinking population continuously forces Japanese companies to expand to new markets and innovate new products to provide additional revenue sources. To achieve this, companies are placing more importance on training their young workforce as global professionals, in order to see them succeed not only in Japan but also in newly developing markets.

The future of nuclear power generation in Japan remains very uncertain after the ongoing disaster in Fukushima Daiichi. At the same time, many companies are investigating business opportunities in new energy-related segments.

Risk and crisis management is another issue in the aftermath of the earthquake and Thailand flood disasters. Companies are re-evaluating their supply chain, infrastructure management and corporate governance. This may be an impediment for additional capital investments. Similarly, fraud allegations regarding Olympus Corp may be another factor for corporate governance improvement activities.

Individual trends: work-life balance, self-development, smart saving

The earthquake left a deep impact on the Japanese. It was a strong shake for a nation, which had been in a hole of hopelessness due to the post-bubble economy for more than two decades.

The earthquake left a deep impact on the Japanese. It was a strong shake for a nation, which had been in a hole of hopelessness due to the post-bubble economy for more than two decades.

With the help of social media such as Facebook and Twitter acting as catalysts, class and alumni reunions have significantly increased. “Kizuna”, which means “bond between people”, has become the motto of post-quake Japan.

Also, important decisions such as marriage or career changes, which were being postponed, are now more frequent. In a break from traditional attitudes toward work, more importance is being given to work-life balance rather than to committing one’s life fully to the company and endless overtime work.

On the other hand, long discussions about the consumption tax hike as well as global economic concerns remind the Japanese to save smartly and continuously as usual. Very rich product lineups and penetration of Internet commerce and smart phones make it always possible to find most economical alternatives.

Impact on Islamic finance

During the last five years, strong roots have been planted for the success of Islamic finance in Japan. Active involvement by government, legislation, and academy, as well as interest by the mainstream media and industry practitioners have helped as catalysts.

During the last five years, strong roots have been planted for the success of Islamic finance in Japan. Active involvement by government, legislation, and academy, as well as interest by the mainstream media and industry practitioners have helped as catalysts.

As Bank of Tokyo-Mitsubishi UFJ’s Malaysia unit launched a new Murabahah product in early January 2012, I believe Japanese companies’ interests in serving Islamic markets will significantly increase in 2012. We can expect new service offerings in Asia by Japanese companies. In the long term, I believe, Islamic finance methodologies will find their niche opportunities in the Japanese domestic market as well.

Serdar A Basara is the president of Japan Islamic finance. He can be contacted at basara@japanislamicfinance.comKorea: Government intervention crucial

Yong-Jae Chang

In Korea, market participants have been expecting significant developments in the Islamic finance market with keen interest over the last couple of years. In February 2011, a bill was re-introduced to amend the Special Tax Treatment Control Act (STTCA) by the Korean government and it contained provisions which would neutralize the existing unfavorable tax treatment of Sukuk transactions. Nevertheless, it was suspended indefinitely by the Korean National Assembly due to the strong opposition from Korean Christian groups who had lobbied against the bill previously. This current setback is not the first but the third time the bill to amend the STTCA has drifted aimlessly.

Previous reform efforts

In late September 2009, the Korean government (in particular, the ministry of strategy and finance) prepared a draft amendment of STTCA and tried to submit it to the National Assembly for approval. Although the effort was not successful, the proposed amendment aims to recognise the need for offshore Sukuk transactions as an alternative method of raising funds and neutralize the existing unfavorable tax treatment on such transactions. The major impediment for Korean entities tapping into the Sukuk market has been the various taxes (including an acquisition tax and a registration tax) which could be imposed on a typical Sukuk structure under the current Korean tax laws. For instance, a typical Sukuk-al-Ijarah structure, which involves the transfer as well as the lease of an underlying asset, is subject to the adverse tax consequences of having to pay various taxes twice (at the time of (i) an initial transfer to an offshore special purpose vehicle (SPV) and (ii) another transfer back to the seller), making Sukuk an unfeasible form of financing for Korean entities. Thus, it is critical to waive such unfavorable tax treatment in connection with Sukuk transactions in order to level the playing field between Sukuk and other conventional foreign currency-denominated notes or bonds issued by Korean entities (as the latter are given preferential withholding tax exemption on interest payments).

In late September 2009, the Korean government (in particular, the ministry of strategy and finance) prepared a draft amendment of STTCA and tried to submit it to the National Assembly for approval. Although the effort was not successful, the proposed amendment aims to recognise the need for offshore Sukuk transactions as an alternative method of raising funds and neutralize the existing unfavorable tax treatment on such transactions. The major impediment for Korean entities tapping into the Sukuk market has been the various taxes (including an acquisition tax and a registration tax) which could be imposed on a typical Sukuk structure under the current Korean tax laws. For instance, a typical Sukuk-al-Ijarah structure, which involves the transfer as well as the lease of an underlying asset, is subject to the adverse tax consequences of having to pay various taxes twice (at the time of (i) an initial transfer to an offshore special purpose vehicle (SPV) and (ii) another transfer back to the seller), making Sukuk an unfeasible form of financing for Korean entities. Thus, it is critical to waive such unfavorable tax treatment in connection with Sukuk transactions in order to level the playing field between Sukuk and other conventional foreign currency-denominated notes or bonds issued by Korean entities (as the latter are given preferential withholding tax exemption on interest payments).

Difficulties with characterisation of Sukuk

Although Sukuk bears a strong resemblance to conventional notes or bonds under the Korean Commercial Code (KCC), Sukuk do not fit into one of the types of corporate bonds which are exhaustively defined in the KCC. Thus, a Sukuk is not an instrument which can be issued under the KCC. There have been certain initiatives to, for instance, add a definition of a new type of investment securities that can be issued by a Korean company and such investment securities would be defined broadly enough to encompass Sukuk. However, no actual steps have been taken by the Korean government to introduce such amendment legislation to date.

Although Sukuk bears a strong resemblance to conventional notes or bonds under the Korean Commercial Code (KCC), Sukuk do not fit into one of the types of corporate bonds which are exhaustively defined in the KCC. Thus, a Sukuk is not an instrument which can be issued under the KCC. There have been certain initiatives to, for instance, add a definition of a new type of investment securities that can be issued by a Korean company and such investment securities would be defined broadly enough to encompass Sukuk. However, no actual steps have been taken by the Korean government to introduce such amendment legislation to date.

Twist of fate

The Korean market participants previously thought that Korea would pave the way for issuance of Sukuk well ahead of Japan. However, this prediction turned out to be completely wrong. In late May 2011, the Japanese government promulgated its so-called ‘J-Sukuk Tax Reform Act’ (as part of the amendments to the Financial Instruments and Exchange Act and other related laws in Japan) after the Japanese parliament passed the bill. Although there is a sunset provision in its tax reform (which makes it effective until the 31st March 2013), it is a very significant development in Japan because it will facilitate Islamic finance in Japan with an aim to make Japan one of the Islamic finance centers in Asia. Unlike Korea which only tried to allow offshore Sukuk transactions by Korean entities (using an offshore SPV which will issue Sukuk), Japan has opened up its domestic market for Islamic finance. Eventually, depending on how quickly and actively Islamic finance is adopted and promoted in Japan, it is most likely to be a good model in the future for Korea (which shares a similar civil law system and legal principles with Japan) if and when the Korean government and the Korean National Assembly decide to facilitate Islamic finance in Korea.

The Korean market participants previously thought that Korea would pave the way for issuance of Sukuk well ahead of Japan. However, this prediction turned out to be completely wrong. In late May 2011, the Japanese government promulgated its so-called ‘J-Sukuk Tax Reform Act’ (as part of the amendments to the Financial Instruments and Exchange Act and other related laws in Japan) after the Japanese parliament passed the bill. Although there is a sunset provision in its tax reform (which makes it effective until the 31st March 2013), it is a very significant development in Japan because it will facilitate Islamic finance in Japan with an aim to make Japan one of the Islamic finance centers in Asia. Unlike Korea which only tried to allow offshore Sukuk transactions by Korean entities (using an offshore SPV which will issue Sukuk), Japan has opened up its domestic market for Islamic finance. Eventually, depending on how quickly and actively Islamic finance is adopted and promoted in Japan, it is most likely to be a good model in the future for Korea (which shares a similar civil law system and legal principles with Japan) if and when the Korean government and the Korean National Assembly decide to facilitate Islamic finance in Korea.

What the future holds for Korea

It is currently unclear when the draft amendment of the STTCA will actually take place. The recent political environment in Korea presents a very gloomy outlook for Islamic finance since the ruling party (Grand National Party) is in deep turmoil at present and there will be crucial elections in 2012 (both parliamentary polls and a presidential vote to be held in April and December, respectively).

It is currently unclear when the draft amendment of the STTCA will actually take place. The recent political environment in Korea presents a very gloomy outlook for Islamic finance since the ruling party (Grand National Party) is in deep turmoil at present and there will be crucial elections in 2012 (both parliamentary polls and a presidential vote to be held in April and December, respectively).

It is also expected that Korean Christian groups will continue to lobby against the bill and they pose a significant threat to not only the passage of the bill but also the outcome of upcoming elections next year. Thus, at least in Korea, the promotion of Islamic finance in the near future cannot avoid an undesirable religious battle.

Although it is highly unlikely that new significant developments in relation to Islamic finance will be introduced in Korea in 2012, there are still market participants in Korea with continued interest (and even enthusiasm) in Islamic finance products. The amendment of STTCA will be a very important first step in the right direction and it will facilitate a framework for issuing Sukuk offshore and ultimately provide a momentum for accepting Islamic finance products within the Korean financial market.

Yong-Jae Chang is a partner at Lee & Ko and he can be contacted at yjc@leeko.comMalaysia: Cautiously optimistic

Raja Teh Maimunah Raja Abdul Aziz

2011 was nothing short of tumultuous: from nature displaying its furious might with the most powerful earthquake recorded in Japan, to human failings in managing economies resulting in the unprecedented and seemingly uncontained spread of the debt crisis in Europe and the downgrade of the US ‘AAA’ sovereign rating. Will the year of the dragon bring greater cheer?

2011: A review

2011 generally held well for Malaysia despite some rippling effects from the European financial and economic crisis. Malaysia recorded a 5.8% gross domestic product (GDP) growth in its third quarter ending September, after expanding 4.3% in the second quarter. Real GDP for the first half of the year expanded 4.4% year-on-year.

2011 generally held well for Malaysia despite some rippling effects from the European financial and economic crisis. Malaysia recorded a 5.8% gross domestic product (GDP) growth in its third quarter ending September, after expanding 4.3% in the second quarter. Real GDP for the first half of the year expanded 4.4% year-on-year.

The Malaysian Islamic banking sector continued to soldier on and recorded a growth of 22% in 2011.

Malaysia retained its position as the market leader in the Sukuk market in 2011 with a total RM45 billion (US$14.5 billion) worth of Sukuk issued.

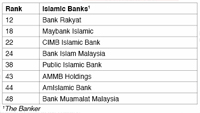

Malaysian Islamic banks also emerged prominently on the global landscape with eight local banks listed among the top 500 Islamic financial institutions in 2011:

2012: A preview

The general outlook for 2012 is cautious optimism for Malaysia. The Eurozone crisis will continue to put pressure on interest rates as countries face the threat of ratings downgrades. Exports are likely to slow down due to heightened austerity measures in crisis-laden countries driving consumer spending down.

The general outlook for 2012 is cautious optimism for Malaysia. The Eurozone crisis will continue to put pressure on interest rates as countries face the threat of ratings downgrades. Exports are likely to slow down due to heightened austerity measures in crisis-laden countries driving consumer spending down.

Malaysia’s economy is expected to be driven largely by domestic consumption and government policies; in particular the Economic Transformation Program (ETP). Mega infrastructure projects, such as My Rapid Transit and the River of Life, are expected to generate significant multiplier effects in the economy. Consumer sentiment however may be slightly impacted by measures undertaken by the central bank, Bank Negara Malaysia (BNM), to manage Malaysia’s household debt: for example, by using net income to determine eligibility for loans and imposing a cap on the amount of credit extended by credit cards for cardholders with income levels of less than RM3,000 (US$967.7) per month.

The Malaysian Institute of Economic Research (MIER) expects the economy to grow by 4.6% in 2011 and 5% in 2012. It also expects inflation to trend lower to 2.7% next year. The IMF has projected Malaysia’s economy to grow by 5.2% this year and 5.1% in 2012. The World Bank forecast Malaysia’s economy to grow at 4.3% for 2011 and 4.9% for 2012 and headline inflation to be at around 3.2% in 2011 and soften to 2.7% in 2012.

Commodities account for about 40% of Malaysia’s exports. The general consensus is that China’s appetite for commodities will continue and commodity prices are expected to sustain despite the overall weak global economy.

Islamic banking and finance is expected to continue expanding and Malaysia has positioned itself to capture 25% of the domestic market share in the Islamic banking and finance sectors by 2012.

Malaysia is expected to continue dominating the global Sukuk market in 2012 with an estimated US$30 billion worth of Sukuk in the pipeline to be issued in Malaysia. Malaysia’s record RM30.6 billion (US$9.87 billion) corporate Sukuk sale from PLUS Expressways in January 2012, mega infrastructure projects under the ETP and the relatively low yields and high liquidity will likely set Malaysia out for a good year for the Sukuk market.

Malaysia is expected to continue dominating the global Sukuk market in 2012 with an estimated US$30 billion worth of Sukuk in the pipeline to be issued in Malaysia. Malaysia’s record RM30.6 billion (US$9.87 billion) corporate Sukuk sale from PLUS Expressways in January 2012, mega infrastructure projects under the ETP and the relatively low yields and high liquidity will likely set Malaysia out for a good year for the Sukuk market.

The recent launch of the second 10-year Financial Sector Blueprint is also expected to further enhance the competitiveness and dynamism of the financial sector. The Blueprint sets out various strategies to promote inclusive access to financial services; encourage the development of the range of financial institutions, products and markets that will facilitate and drive the development of new domestic sources of growth; and accelerate Malaysia’s regional and international connectivity.

The governor of Bank Negara Malaysia says: “An important part of this will be the internationalization of Islamic finance and the development of Malaysia as an international Islamic financial center.”

In general, Malaysia is anticipated to hold its defenses this year with public consumption, government-driven projects and ease of access to the financial markets. The Islamic finance industry is consequently expected to benefit from the heightened infrastructure activity and continued regulatory support and incentives to develop the country as an international Islamic financial center.

Raja Teh Maimunah Raja Abdul Aziz is CEO of Hong Leong Islamic Bank. She can be contacted at RajaTehMaimunah@hlisb.hongleong.com.mySingapore: High expectations

Yeo Wico and Suhaimi Zainul-Abidin

2010 was undoubtedly a hugely successful year for Islamic finance in Singapore, featuring deals such as the initial public offering of Sabana Shariah Compliant Real Estate Investment Trust, the largest Shariah compliant REIT by total assets globally, which raised gross proceeds of approximately S$664.4 million (US$523.3 million), garnering the IPO Deal of the Year Award 2010 and the Real Estate Deal of the Year Award 2010 by Islamic Finance news; and the issue by Danga Capital of S$600 million (US$472.5 million) trust certificates due 2015 and S$900 million (US$708.7 million) trust certificates due 2020 with Khazanah Nasional as obligor (garnering the Singapore Islamic Finance Deal of the Year Award 2010 and Corporate Finance Deal of the Year Award 2010 by Islamic Finance news).

On the back of the strides made by the Islamic finance industry in Singapore in 2010, the achievements made in the Islamic finance markets in Singapore in 2011 appear modest in comparison but have the potential of laying the groundwork for long-term growth. Existing Shariah compliant structures have continued to evolve in Singapore in 2011, indicating the development in both the depth and breadth of Singapore’s Islamic finance market. Furthermore, there have also been regulatory and tax developments made to support the Islamic finance industry in Singapore. These factors suggest that Islamic finance will continue to have good prospects in 2012.

A round-up of 2011

Despite the relatively quieter 2011 for Islamic finance in Singapore, there were still notable deals concluded. One of the more significant deals in 2011 was the S$144.3 million (US$113.6 million) additional term and commodity Murabahah facilities made available to Sabana Shariah Compliant REIT, which enabled the Shariah compliant REIT to acquire further industrial properties in Singapore and further grow its portfolio and strengthen its position as the largest Shariah compliant REIT globally. The Murabahah facilities have been innovatively structured to incorporate a profit rate hedge into the Murabahah structure to increase transaction efficiency by minimising the number of Murabahah trades.

Despite the relatively quieter 2011 for Islamic finance in Singapore, there were still notable deals concluded. One of the more significant deals in 2011 was the S$144.3 million (US$113.6 million) additional term and commodity Murabahah facilities made available to Sabana Shariah Compliant REIT, which enabled the Shariah compliant REIT to acquire further industrial properties in Singapore and further grow its portfolio and strengthen its position as the largest Shariah compliant REIT globally. The Murabahah facilities have been innovatively structured to incorporate a profit rate hedge into the Murabahah structure to increase transaction efficiency by minimising the number of Murabahah trades.

Even though fewer large Islamic finance deals were concluded in 2011, many deals remain in the pipeline and the prospects for Islamic finance in Singapore remain bright.

Regulatory developments

New regulatory developments took effect in 2011 which reaffirmed the dedication of the Singapore government, regulatory and tax authorities to grow the Islamic finance market and ecosystem in Singapore. Regulatory and tax changes to promote and facilitate Islamic finance in Singapore have been systematically promulgated since from 2006, first to allow banks to carry on Murabahah financing transactions and subsequently to carry on Ijarah-based financing and Murabahah interbank placements and undertake diminishing Musharakah and spot Murabahah transactions, with the addition of Istisnah transactions to the list of permitted transactions in 2010.

New regulatory developments took effect in 2011 which reaffirmed the dedication of the Singapore government, regulatory and tax authorities to grow the Islamic finance market and ecosystem in Singapore. Regulatory and tax changes to promote and facilitate Islamic finance in Singapore have been systematically promulgated since from 2006, first to allow banks to carry on Murabahah financing transactions and subsequently to carry on Ijarah-based financing and Murabahah interbank placements and undertake diminishing Musharakah and spot Murabahah transactions, with the addition of Istisnah transactions to the list of permitted transactions in 2010.

Tax treatment of the prescribed types of Islamic financing was further clarified in 2011. This is in line with the Singapore government’s policy of harmonizing the tax treatment of Islamic financing contracts with that of their equivalent conventional counterparts, an approach which dates back to 2006.The previous circular issued by the Monetary Authority of Singapore (MAS) on the tax treatment of Islamic financing arrangements in 2006 covered only Murabahah, Mudarabah and Ijarah Wa Igtina transactions and Sukuk issuances. The MAS Circular issued in 2011 further clarified the position relating to Murabahah and also explained the income tax, stamp duty and GST treatment of Musharakah, Istisnah and Wakalah-based structures. For example, the 2011 Circular confirmed that double or triple stamp duties would be waived on Murabahah deposits where the asset was immovable property, as additional imposition of stamp duty would result in Murabahah deposits being less competitive than comparable conventional deposits. The measures outlined in the 2011 Circular were also mirrored in Singapore’s income tax subsidiary legislation with retrospective effect.

The guidance provided in the circulars and the income tax legislation has provided greater certainty to banks and investors by confirming positions which had previously been adopted by regulators in dealing with specific transactions. These tax clarifications will help ensure that the regulatory and tax framework in Singapore remains transparent and predictable with regard to Islamic financing transactions.

Looking ahead: 2012

Singapore’s regulatory authorities have continued in their efforts to accelerate the development of Islamic finance in Singapore, reinforced by MAS’s launch of its own Sukuk facility in 2009. In addition, efforts have been made to develop human capital for Islamic finance in Singapore, by focusing on education through Islamic finance courses offered by institutions such as the Center for Islamic Management Studies and the Singapore Management University. The trajectory for growth of Islamic finance in Singapore is firm and it is anticipated that deals in the pipeline will come to fruition.

Singapore’s regulatory authorities have continued in their efforts to accelerate the development of Islamic finance in Singapore, reinforced by MAS’s launch of its own Sukuk facility in 2009. In addition, efforts have been made to develop human capital for Islamic finance in Singapore, by focusing on education through Islamic finance courses offered by institutions such as the Center for Islamic Management Studies and the Singapore Management University. The trajectory for growth of Islamic finance in Singapore is firm and it is anticipated that deals in the pipeline will come to fruition.

Yeo Wico and Suhaimi Zainul-Abidin are partners at Allen & Gledhill. They can be contacted at yeo.wico@allenandgledhill.com and suhaimi.zainul@allenandgledhill.com respectively.

Thailand: Focusing on capital markets

Dr. Subhak Siwaraksa and Badlisyah Abdul Ghani

Thailand, a multi-religious country, witnessed the launch of the first Islamic Bank, known as the Government Saving Bank, in 1998. A year later, the Bank for Agriculture and Agricultural Cooperatives (BAAC) introduced Islamic windows in certain areas in Bangkok and southern Thailand. By 2001, Krung Thai Bank opened its Islamic banking branch in southern Thailand which was subsequently bought over by the Islamic Bank of Thailand (IBT). Thailand has a clear intention of setting up an Islamic bank under the government’s jurisdiction with its own set of laws; hence the drafting of The Islamic Bank of Thailand Act by the ministry of finance (MoF) which was approved by parliament in October 2002.

In 2007, Thailand passed the Trust for Transactions in Capital Market Act B.E. 2550 which initiated the concept of trust for the benefit of capital market transactions. The establishment of the Trust Act by the Securities Exchange Commission (SEC) paved the way for the issuance of Sukuk, i.e. Sukuk Notification, which took effect in January 2011. This notification shall be used for Sukuk Issuance and Offering, defined as “the financial instrument from the Islamic principle (Shariah) with the characteristic of a Trust Certificate issued by the asset trustee”.

The SEC is also working with related agencies to amend the related notifications for different types of investors to invest in Sukuk, including mutual, provident and government pension funds as well as financial institutions and insurance companies.

Review of 2011: A focus on Islamic capital markets

On asset management, CIMB-Principal Asset Management Co. (Thai) (CPAM (T)) will be offering two Shariah compliant mutual funds. Based on a feeder fund concept, two new funds will be created in Thailand which will feed 100% into CPAM’s existing funds domiciled in Malaysia (i.e. CIMB Islamic Enhanced Sukuk Fund and CIMB Islamic Global Commodities Equity Fund). CPAM (T) will then offer the funds to financial institutions in Thailand where there are gaps in their offering to their retail investors. IBT for instance can add these funds to its wealth management product offering.

On asset management, CIMB-Principal Asset Management Co. (Thai) (CPAM (T)) will be offering two Shariah compliant mutual funds. Based on a feeder fund concept, two new funds will be created in Thailand which will feed 100% into CPAM’s existing funds domiciled in Malaysia (i.e. CIMB Islamic Enhanced Sukuk Fund and CIMB Islamic Global Commodities Equity Fund). CPAM (T) will then offer the funds to financial institutions in Thailand where there are gaps in their offering to their retail investors. IBT for instance can add these funds to its wealth management product offering.

The prospectuses have been submitted to the SEC for approval and have been endorsed by CIMB Islamic Shariah Committee, even in the absence of guidelines on the formation of Shariah compliant funds (we understand these are currently in the works). Currently, there are three Islamic funds domiciled in Thailand: MFC Islamic Long Term Equity, KTAM-Krung Thai Shariah LTF and KTA-Krung Thai Shariah RMF.

Sukuk

The discussions on the release of the Sukuk Notification started since 2010; the SEC initiated a series of active discussions with the stakeholders of the capital market industry, including representatives from IBT, CIMB Group and Baker & McKenzie, forming part of the SEC Sub-Committee, which oversees the drafting and releasing of applicable regulations signifying Thailand’s commitment to developing the Islamic debt capital market.

The discussions on the release of the Sukuk Notification started since 2010; the SEC initiated a series of active discussions with the stakeholders of the capital market industry, including representatives from IBT, CIMB Group and Baker & McKenzie, forming part of the SEC Sub-Committee, which oversees the drafting and releasing of applicable regulations signifying Thailand’s commitment to developing the Islamic debt capital market.

The main highlights of the Sukuk Notification include:

• The definition of Sukuk as a financial instrument being a trust certificate issued by an asset trustee.

• Requirement of two advisers: (i) A legal advisor who gives an opinion as to whether or not the trust instrument is enforceable under the law; and (ii) A Shariah advisor who will issue an opinion on whether the characteristics of such Sukuk comply with Shariah principles.

• No mention on Shariah principles allowed. However, the principle/s must be determined for the purpose of utilizing the Sukuk issue proceeds to seek benefits in the forms that comply with the Shariah principles.

• The definition of Sukuk as a financial instrument being a trust certificate issued by an asset trustee.

• Requirement of two advisers: (i) A legal advisor who gives an opinion as to whether or not the trust instrument is enforceable under the law; and (ii) A Shariah advisor who will issue an opinion on whether the characteristics of such Sukuk comply with Shariah principles.

• No mention on Shariah principles allowed. However, the principle/s must be determined for the purpose of utilizing the Sukuk issue proceeds to seek benefits in the forms that comply with the Shariah principles.

Despite the existence of the Sukuk Notification, no Sukuk has been issued to date, due to the outstanding tax issues. In May 2011, the cabinet of Thailand approved the proposal for tax relief for transactions in relation to Sukuk issuance, including value added tax and special business tax, aimed at achieving a level playing field for Sukuk. It is currently being assessed by the Council of State before being passed into law.

Offshore, Trans Thai-Malaysia (TTMT)’s debut serial Sukuk issuance (via a 100%-owned Malaysian Special Purpose Vehicle, TTM Sukuk) stands out as a landmark cross-border Sukuk deal. The US$190 million-equivalent Sukuk, under the principle of Murabahah, was utilized for the refinancing of Phase II of TTMT’s pipeline project. The sponsors are Thailand’s national oil company, PTT Public Company and Malaysia’s national oil company, Petroliam Nasional, each with a 50% stake. The transaction marks numerous ‘firsts’ and is a momentous achievement: including;

(i) The first Thai incorporated entity raising funds from the ringgit market via a ringgit-denominated Sukuk;

(ii) The first foreign entity to raise project financing via a Sukuk in Malaysia and;

(iii) The longest issue of Sukuk in Malaysia of up to 15 years by a foreign issuer. CIMB is the joint lead arranger, manager, bookrunner and Shariah adviser.

(ii) The first foreign entity to raise project financing via a Sukuk in Malaysia and;

(iii) The longest issue of Sukuk in Malaysia of up to 15 years by a foreign issuer. CIMB is the joint lead arranger, manager, bookrunner and Shariah adviser.

On the Equity front there is a Dow Jones Islamic Market (DJIM) Thailand Index and Thailand also makes up part of the DJIM Asean Index, indicating there is a respectable number of Shariah compliant companies listed on the Thai stock exchange. As at the end of November 2011 there were 37 components in the DJIM Thailand Index, or approximately 27% of its parent benchmark index in terms of market capitalization.

Preview 2012

The IBT is likely to be the first issuer of baht-denominated Sukuk in Thailand. It is currently awaiting clarification on the tax relief for Sukuk before proceeding with the landmark issuance, which will inevitably pave the way for other state-owned entities to issue Sukuk. The Thai bond market is only second to Malaysia within the Asean region and we should expect a flurry of activities in the Sukuk market amongst the Thai issuers once the relevant laws have been passed and the tax issue has been resolved.

The IBT is likely to be the first issuer of baht-denominated Sukuk in Thailand. It is currently awaiting clarification on the tax relief for Sukuk before proceeding with the landmark issuance, which will inevitably pave the way for other state-owned entities to issue Sukuk. The Thai bond market is only second to Malaysia within the Asean region and we should expect a flurry of activities in the Sukuk market amongst the Thai issuers once the relevant laws have been passed and the tax issue has been resolved.

Dr Subhak Siwaraksa is president & CEO of CIMB Thai Bank while Badlisyah Abdul Ghani is the executive director/CEO of CIMB Islamic Bank. They can be contacted at subhak.s@cimbthai.com and badlisyah.abdulghani@cimb.com respectively.

No comments:

Post a Comment